This will be my final newsletter for HIVE. I’ve truly enjoyed writing this publication and connecting with you all. Stay tuned as the publication evolves and thank you for being a loyal subscriber.

As a finale, I’d like to briefly lay out my 10-year bull case for Bitcoin.

Let’s start with what Bitcoin is, fundamentally, because there are a few different narratives floating around.

Bitcoin was designed to do one thing: become an alternative to fiat money. This is clear from Satoshi’s writing, especially the message he encoded in the very first block in January 2009.

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

It’s a timestamp featuring a newspaper headline from that day. Bitcoin was launched during the global financial crisis (GFC), and the bailouts appear to have been a primary motivator for Satoshi.

From its very beginning, the core of Bitcoin has been about scarcity and a fair playing field. Digital gold is the correct way to think about it. A decentralized way to store and transfer value, with strict rules governing its monetary policy.

After the halving event this April, Bitcoin’s annual inflation rate will decrease to 0.9%, down from 1.8%.

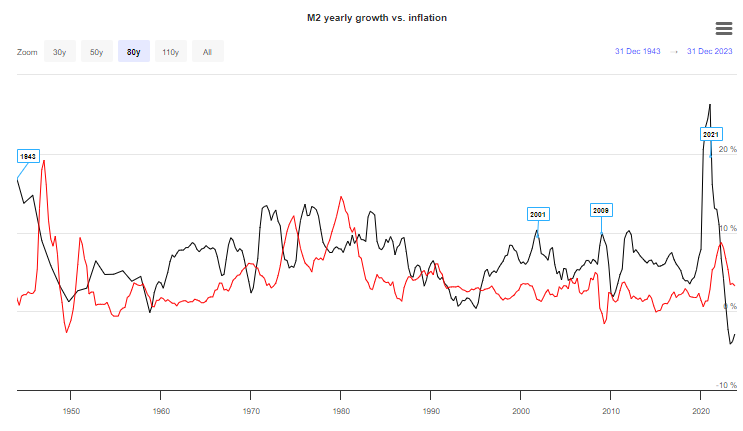

Let’s compare Bitcoin’s sub-1% inflation rate with the U.S. dollar in recent years. Take a look at the remarkable chart below, which shows U.S. M2 money supply growth in black, and the official inflation rate in red.

As you can see, U.S. money supply growth somewhat regularly surpasses 10%, and in 2021 hit a shocking 26%. You can also see the clear connection between money printing and inflation in this chart.

For now, U.S. money supply is actually contracting. This is the Fed’s higher and tighter monetary policy in action. But can it last?

The Ultimate Monetary Policy Pickle

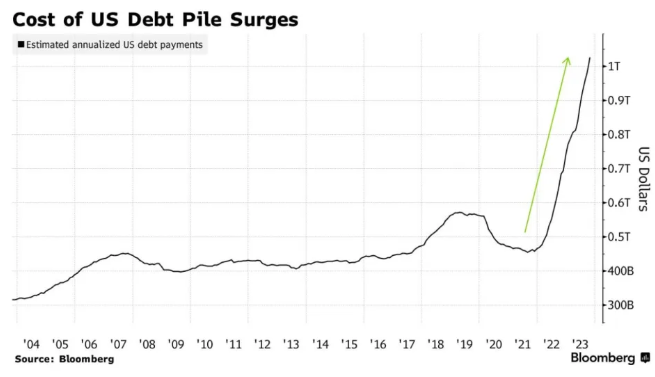

Since the Federal Reserve began raising interest rates, the cost the U.S. government pays to service its debt has skyrocketed.

In November of 2023 U.S. annual debt interest payments surged past $1 trillion (more than the yearly defense budget).

The remarkable hockey-stick-growth in debt servicing costs is clearly unsustainable. If rates stay at current levels, it will quickly snowball out of control.

How could the Fed and government address this growing problem? The Fed pivot, of course. Lowering interest rates and re-starting QE (money printing) operations. All the money that’s needed can be printed. But of course, that has downsides as well. It would almost certainly cause inflation to resurge.

It seems the only viable alternative would be to slash government spending by ~40%, but this seems downright impossible in today’s political environment.

There are no good options. The Fed and Treasury are stuck in the ultimate monetary policy pickle. I suspect they will be forced to restart QE and lower rates this year, but I have been wrong on the timing of the pivot before.

The truth is that no matter what the Fed and Treasury decide to do, it’s going to be a chaotic decade. All roads lead to financial mayhem, in one form or another.

Bitcoin Was Built for This

When Satoshi first told the world about Bitcoin, his introduction provided instant insight into his motivations.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

Satoshi saw the problems with fiat currency and built a project he hoped could address some of these issues. Bitcoin was designed to be scarce, apolitical, and decentralized.

Against the odds, it caught on. Estimates on the total number of BTC owners today vary from 50 million to 219 million. We don’t know the exact number, but it’s safe to say it’s a large and growing user base.

If the next decade is as crazy as I suspect it will be, Bitcoin’s user base will be much larger in the future. And every person doesn’t have to own much for it to make a difference in demand. Consider this insane statistic:

Given that a bitcoin currently costs $43,319, there are only enough bitcoins for every person [on Earth] to have $105.90 worth.

I like this stat and think it’s a great way to put things into perspective.

Cheers,

Adam Sharp

The HIVE Newsletter