The HIVE Newsletter

Crypto enthusiasts and investors are preparing for the imminent halving of Bitcoin. At HIVE, many shareholders are interested to know the impact that this historic event might have on the company as well as the broader Bitcoin market.

In today’s newsletter, we’ll explore how halvings have historically affected the mining industry, review the Company’s strategy during the 2020 halving, and discuss HIVE’s ongoing preparations for the April 2024 halving event.

Let’s start by taking a look at an excellent piece of research by Fidelity Digital Assets’ analyst Daniel Gray, titled “Understanding the Bitcoin Halving”. The report is extremely well done, and I recommend reading it in full if you want a comprehensive understanding of the halving.

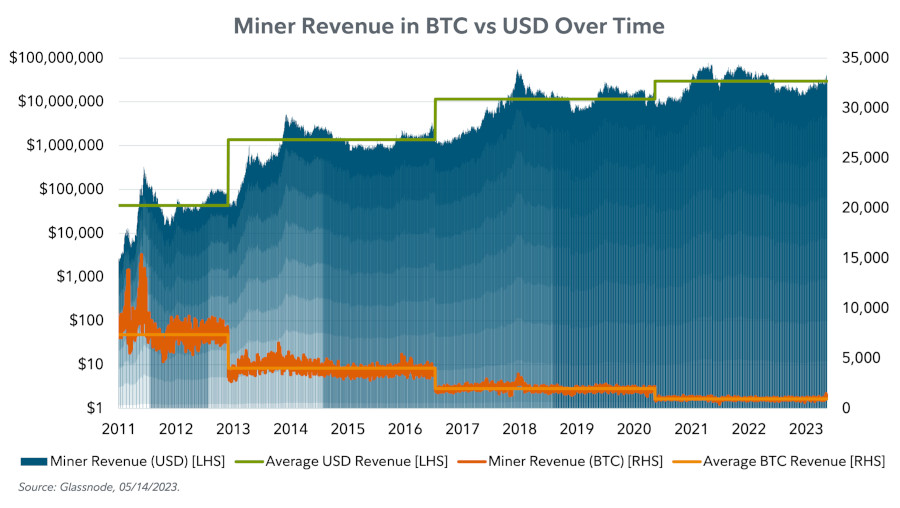

So how have halvings historically impacted miners? Take a look at this fascinating chart from the Fidelity report showing how miner revenue has fallen in BTC terms, yet still risen significantly over time in dollar terms.

Here is the accompanying commentary:

“While the halving continuously lowers the amount of compensation in native bitcoin token terms, we haven’t seen the same thing in USD-denominated terms. Over time, miners have been compensated for their continued work as the price adjusts to the lack of new supply. Because bitcoin’s price is largely dependent on supply and demand, when the issuance is halved and provided demand remains the same, the price may be pressured to rise, all else equal.“

Supply, Demand, and Bitcoin Economics

In certain situations, less can be more. Consider organizations like DeBeers and OPEC, both of which tightly control supply to benefit their respective industries. Bitcoin has such a scarcity mechanism built in.

Bitcoin’s annual inflation rate has dropped from over 1,000,000% in the very early days to 1.8% today. After the April halving event, it will be 0.9%.

As we discussed a few weeks ago, after the April 2024 halving, the new daily supply of Bitcoin will drop from around 900 to around 450. At $34,000 per BTC, that’s a drop from $30.6 million worth of new daily supply to $15.3 million.

Over the course of a year that’s a whopping $5.584 billion (at $34k BTC) less Bitcoin entering the system. This will have a very significant impact on the supply/demand equation. Should a pivotal event occur which further increases demand, such as U.S. Bitcoin ETFs being approved, that could create a favorable situation for Bitcoin holders and miners.

HIVE’s Halving Strategies, Past and Present

The period directly following the halving event may prove difficult for miners, but if Bitcoin follows its historical pattern, the sharp decrease in supply should lead to significantly higher prices over time as the market adjusts.

HIVE has been through this before during the 2020 halving. In an update HIVE put out in October, Executive Chairman Frank Holmes commented:

“When the 2020 halving happened, it caused significant disruptions in the industry. HIVE seized the opportunity by acquiring large Bitcoin mining operations at significant discounts, because much of the industry was overleveraged. We could see a similar situation unfold over the next six months, and if it does, HIVE will be ready.”

The acquisitions HIVE made around the last halving now form the backbone of the Company’s Bitcoin mining operations. As of November 14, 2023, HIVE produces approximately 9 Bitcoin per day.

In the October production update, Mr. Holmes provided additional color:

“Our team’s proven track record, coupled with our fiscal prudence, puts us in an enviable position to weather the halving event which is currently expected to occur mid-April 2024. Our continued focus is to maximize the ROI on Bitcoin mining ASICs we purchase now, by making strategic acquisitions of only the very best offers in the market.”

The HIVE leadership team has begun to put this plan into action. On November 27, 2023, HIVE Digital announced its acquisition of a data center in Boden, Sweden. The company will utilize this facility to increase its Bitcoin production.

HIVE has also been upgrading its ASIC fleet to achieve rapid ROI and the highest possible efficiency. Here’s an excerpt from the November 14 strategic update.

”…in the last 6 months, HIVE has purchased 8,900 new generation ASICs, including the 3,100 units of the Bitmain S19 XP and 5,800 units of the S19k Pro, which have efficiencies of approximately 22 J/TH and 23 J/TH respectively, all with quick delivery timelines and very attractive $/TH prices.”

In addition, HIVE is expanding its GPU cloud business. The company is using its 38,000 NVIDIA data center GPUs to build an on-demand GPU rental business. Once this venture reaches scale, it should complement HIVE’s Bitcoin business nicely. The revenue should be steadier, and HIVE expects the margins to be favorable. Look for more updates on that soon.

Cheers,

Adam Sharp

The HIVE Newsletter