The HIVE Newsletter

Traditionally, Bitcoin has been viewed as digital gold, a scarce monetary digital asset. Ethereum, on the other hand, has historically been a more flexible crypto platform with the ability to issue tokens and utilize smart contracts.

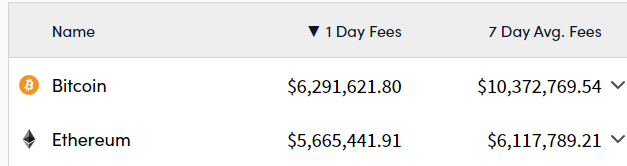

Lately, however, something strange has been happening. The introduction of the Ordinals protocol and BRC-20 tokens on the Bitcoin blockchain has flipped the script, causing Bitcoin to surpass Ethereum in daily transaction fees. This is highly unusual.

BRC-20 tokens are a new type of asset issued on the Bitcoin blockchain using the Ordinals protocol. BRC-20 assets are fungible and transferrable, much like Ethereum’s ERC-20 token standard.

Today the largest BRC-20 asset is ORDI, which boasts a market cap of over $1 billion as of January 3, 2024. So, what is ORDI? Currently, not much… It’s essentially a “meme token” with no real functionality (yet, at least).

Nonetheless, ORDI has already been listed by major exchanges such as Binance and has created significant buzz.

Meme tokens are a somewhat humble beginning, but the reason people are excited is that Ordinals open a new world of possibilities on the Bitcoin blockchain. Today it’s mostly meme tokens, but in the future, stablecoins and security tokens could be issued and traded on the world’s most secure blockchain, Bitcoin.

As of January 3, 2024, Ordinals (primarily BRC-20 tokens) have already generated a whopping $231 million in transaction fees paid to Bitcoin miners since their launch in early 2023.

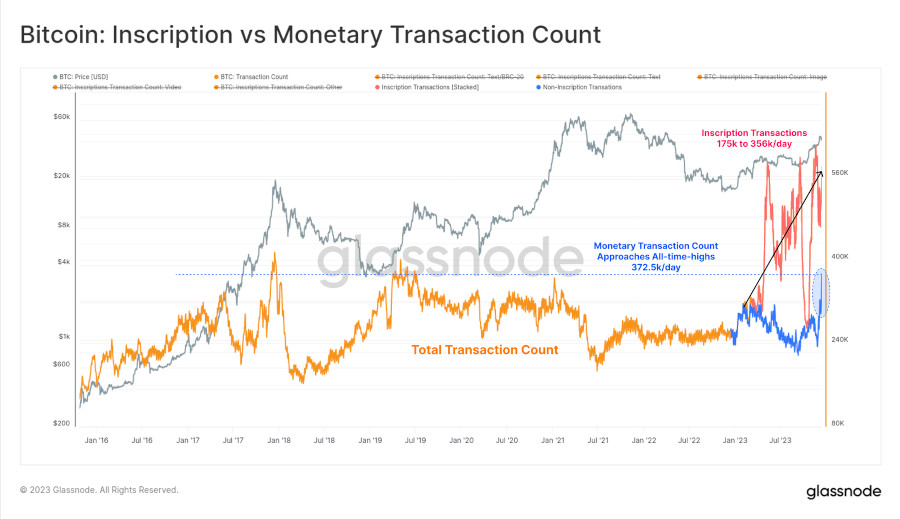

As you can see from the chart below, courtesy of Glassnode’s excellent 2023 On-chain Review, Ordinals inscriptions (red line) make up an increasingly large percentage of transactions on Bitcoin’s blockchain.

BTC Maximalists Aren’t Happy

Miners are obviously thrilled about Ordinals and BRC-20s. These developments are providing a much-needed boost to revenue at a time of soaring mining difficulty, and just ahead of the April 2024 halving event.

But not everyone is so enthusiastic. Many Bitcoin maximalists, for example, are not happy about the development of token issuance on Bitcoin. For starters, fees have risen dramatically since the rise of Ordinals, limiting Bitcoin’s utility for smaller transactions.

There’s also an argument to be made that Ordinals introduce reputational and regulatory risks. Steven Hay of Bitcoin Magazine highlighted these issues back in May of 2023.

With Ordinals popularizing the integration of Bitcoin’s blockchain with all manner of infamous Ethereum innovations (such as NFTs, tokens and, perhaps soon, smart contracts), reputational risk to the Bitcoin protocol grows. How long until a token is issued directly on Bitcoin which passes the Howey Test and so falls afoul of the U.S. Securities and Exchange Commission?

These are important questions for the Bitcoin community to consider. Some in the community are advocating a BIP (Bitcoin Improvement Proposal) which would disable Ordinals and BRC-20s completely. Such a change is technically feasible but would likely face stiff resistance from miners and Ordinals enthusiasts.

Part of the attraction of BRC-20 tokens is that they exist in somewhat of a gray area and are not yet explicitly forbidden in the U.S., like traditional ICOs are. This could change in the future if regulatory agencies begin to crack down on Ordinals.

We’ll keep you updated as this story progresses.

Cheers,

Adam Sharp

The HIVE Newsletter