The first Bitcoin spot ETF application was filed with the SEC in July of 2013 by the Winklevoss twins. More than a decade later, the first batch of Bitcoin spot ETFs were finally approved by the SEC. It’s been a long journey, but the first ETFs finally began trading on Thursday, January 11, 2024.

One of the most interesting aspects of this development is the fee war which has broken out. The blue-chip companies sponsoring these ETFs are competing fiercely on fees, which indicates that they think this market is going to be large.

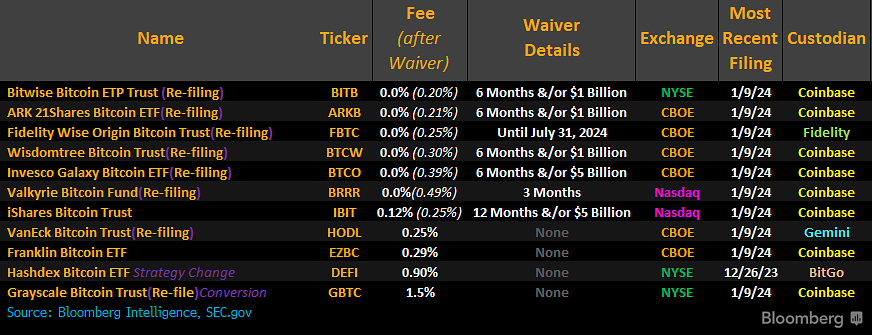

Here’s a chart showing the various fee strategies, courtesy of Bloomberg ETF analyst James Seyffart:

Bitwise’s Bitcoin ETP Trust (BITB) initially came in with the lowest annual fees at 0.24%, before cutting further to 0.2% on January 9. The ARK 21Shares fund (ARKB) is close behind at 0.21%, while VanEck (HODL) and ARK Fidelity (FBTC) are both at 0.25%. Grayscale’s GBTC, which is set to be converted to an ETF, stands out with 1.5% fees and seems to be relying on its existing customer base, some of whom may stick around for a while for tax purposes, or simply get lazy.

It’s worth noting that Bitwise, Invesco, and ARK are all waiving fees for the first six months. Blackrock’s iShares Bitcoin Trust is lowering fees to 0.20% for the first six months or $5 billion in assets under management (AUM).

Expectations appear to be high for Bitcoin spot ETFs. This is great news for investors and should boost inflow volume for these new funds.

As new cash flows into these novel ETFs, the sponsors will be required to buy an equal amount of Bitcoin. Upon yesterday’s approval of the ETFs, there could be a rather large influx of BTC buyers in the very near future.

Can Traditional Crypto Exchanges Compete with ETFs?

There’s an interesting wrinkle to this story. With fees as low as 0.2% per year, it’s probably cheaper for many investors to buy an ETF rather than buying Bitcoin from an exchange like Coinbase.

Coinbase, for example, has fees which start around 0.5% and can go as high as 4.5%. On Coinbase Pro, fees start at 0.6% and go as low as 0.05% for $400M+ trades.

At those rates, anyone who trades more than once per year may be better off with the ETF from a fee perspective. There’s also the added benefit of free trades in almost all online brokerage accounts. Crypto exchanges certainly don’t offer free trades, but I suspect the availability of cheap ETFs will force them to lower fees over time. Alternatively, exchanges may lean into subscription offerings such as Coinbase One, which offers unlimited trades for $29.99 a month.

Additionally, it’s probably a lot easier for the average investor to gain access via a traditional brokerage account or financial advisor, rather than learning how to buy and sell directly on an exchange.

However, there will always be a place for direct Bitcoin investment. You can’t settle a debt or send money overseas with an ETF. For that you’ll still need to buy and utilize Bitcoin the old-fashioned way.

But for investors purely looking for exposure to the price of Bitcoin, I suspect ETFs and public Bitcoin miners will be very popular options going forward. Fees add up, especially for frequent traders. With ETFs offering direct and cheap exposure, I expect Bitcoin volatility may increase, at least temporarily.

We’ll keep readers updated as this story continues to develop. Be sure to check out HIVE Digital’s Twitter/X account for the latest news.

Cheers,

Adam Sharp

The HIVE Newsletter