Bitcoin has climbed around 150% since the start of 2023. Three catalysts which appear to be driving the price higher include the following.

- Potential interest rate cuts in 2024

- Possible Bitcoin spot ETF approval in January 2024

- The scheduled Bitcoin halving in April 2024

Did The Fed Blink on Rates?

On Sunday, December 3, gold suddenly broke out to a new all-time high of over $2,100 an ounce. Bitcoin also raced higher.

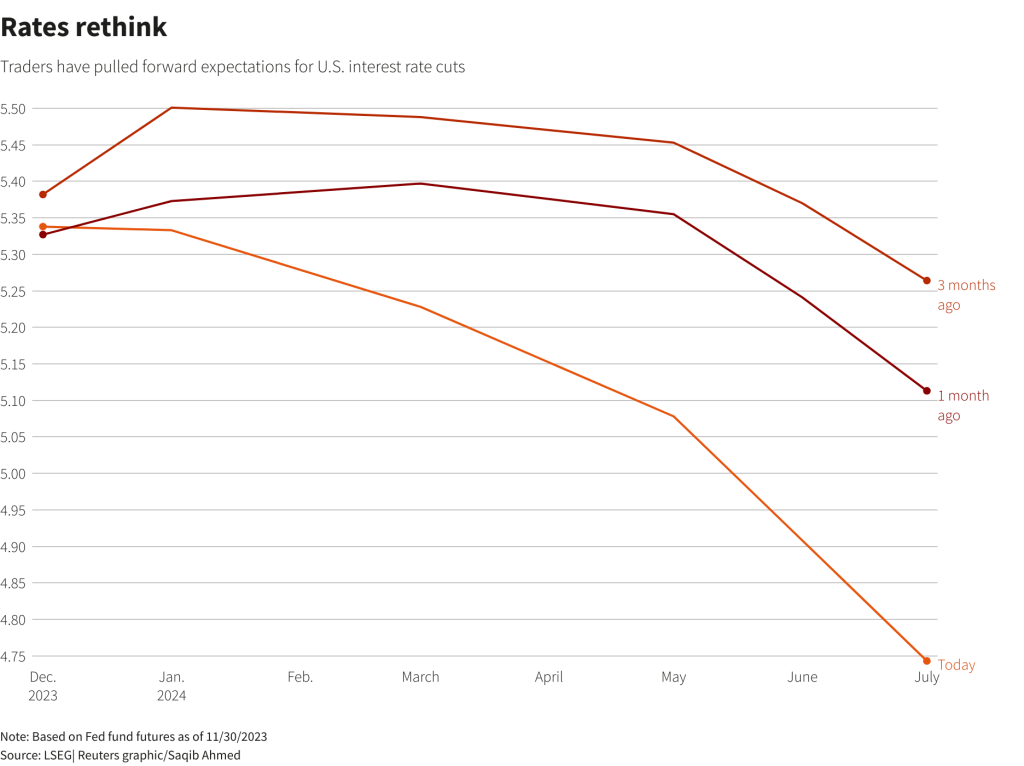

One contributing factor? Traders are betting that the Federal Reserve may cut rates as soon as March of next year. Here’s how the market’s expectations of the Fed funds rate have evolved over the past few months, via Reuters.

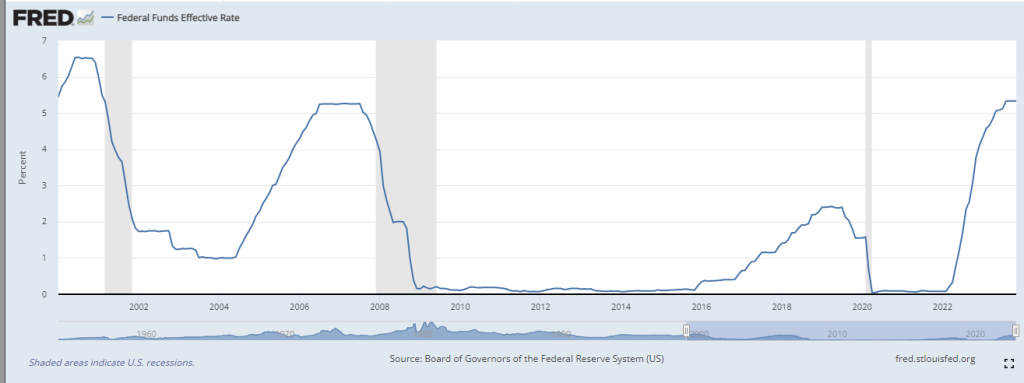

Take a look at the effective federal funds rate (EFFR) since 2000. As you can see, the Fed’s key interest rate has surpassed 5% three times over this period.

However, the EFFR typically doesn’t remain above 5% for long. If we are indeed at the end of this tightening cycle, that could be quite bullish for Bitcoin, which has historically benefitted from loose monetary conditions. Here’s a chart showing how Bitcoin tends to move with global M2 money supply.

U.S. Bitcoin ETFs

Bloomberg ETF analysts James Seyffart and Eric Balchunas have raised their odds of U.S. Bitcoin spot ETF approvals to 90% by January 10, 2024.

Bitcoin spot ETFs would dramatically improve access for both retail and institutional investors. True Bitcoin ETFs would arguably offer a much better solution than current options such as the Grayscale Bitcoin Trust (GBTC), which charges 2% management fees and has not accurately tracked the price of Bitcoin.

The companies filing these ETFs include giants such as Blackrock, Fidelity, Arc Investments, Invesco, and others. Having Bitcoin ETF offerings from such notable firms would offer a huge credibility boost to the industry.

Additionally, in a 2022 Fidelity Digital Assets survey of institutional investor attitudes towards cryptocurrency, two of the primary concerns cited were security and regulatory issues. ETFs from some of the largest investment firms in the world should go a long way towards easing those concerns.

The Halving

We’ve already discussed the April 2024 halving and its impact on Bitcoin supply and demand. With Bitcoin’s inflation rate (new supply entering the system annually) set to drop from 1.8% to 0.9%, the impact on price, all else being equal, should be substantial.

But it’s important to consider the halving in combination with the other two potential catalysts. The halving is a given, it’s definitely going to happen. If one or both of the other catalysts also occur, however, this could create a very bullish scenario for Bitcoin.

It’s possible that we will see a 50% drop in new supply entering the market, Fed rate cuts, and ETF approvals all within a period of a few months. That’s quite a compelling blend of positive fundamentals for Bitcoin.

In July of 2023 multinational bank Standard Chartered predicted that Bitcoin could reach $50,000 by the end of this year and $120,000 by the end of 2024. At the time, Bitcoin was trading around $30,000 and their targets seemed overly optimistic to many. Today, however, those predictions seem quite grounded in reality.

Of course, it’s important to note that Bitcoin is known for its surprise reversals, extended periods of chop, and generally unexpected behavior. So while it’s not a sure thing that we see new all-time highs in 2024, I believe the odds are in our favor.

Cheers,

Adam Sharp

The HIVE Newsletter