On October 31, 2008, Bitcoin creator Satoshi Nakamoto emailed a cryptography mailing list to introduce his big idea. He attached a whitepaper explaining the goals of the project.

At first Satoshi’s proposal drew a skeptical response from the cryptography group. People said Bitcoin wouldn’t scale, or that it’d be hacked to oblivion. They said there was no intrinsic value, so it simply couldn’t work.

15 years later Bitcoin has, against all odds, succeeded. Today Bitcoin sports a roughly $670 billion market cap and has a bustling industry built up around it.

Bitcoin mining is no longer done in garages, it’s done by professionals in industrial data centers. Large cryptocurrency exchanges offer fiat on/off ramps. Massive investment firms like Fidelity have entered the space with Bitcoin-focused offerings.

Today there are numerous venture capital funds dedicated solely to funding Bitcoin-related startups. Meanwhile, the Lightning Network and other advancements are allowing Bitcoin to scale. And soon, we may get proper BTC spot ETFs in the U.S. too.

The Bitcoin ecosystem is thriving, and it’s all because the system Satoshi built is elegant. Its design expertly balances scarcity, security, and speed.

Bitcoin had no inside investors, and there was no ICO (initial coin offering). Anyone, with almost any computer, could have mined Bitcoin in those early days. It was the fairest cryptocurrency launch in history, by far.

Satoshi stopped contributing to Bitcoin around 2011, but an army of open-source developers took up the job of maintaining and improving the project. Today there’s a huge community of skilled developers who contribute to the Bitcoin project.

Progress Report

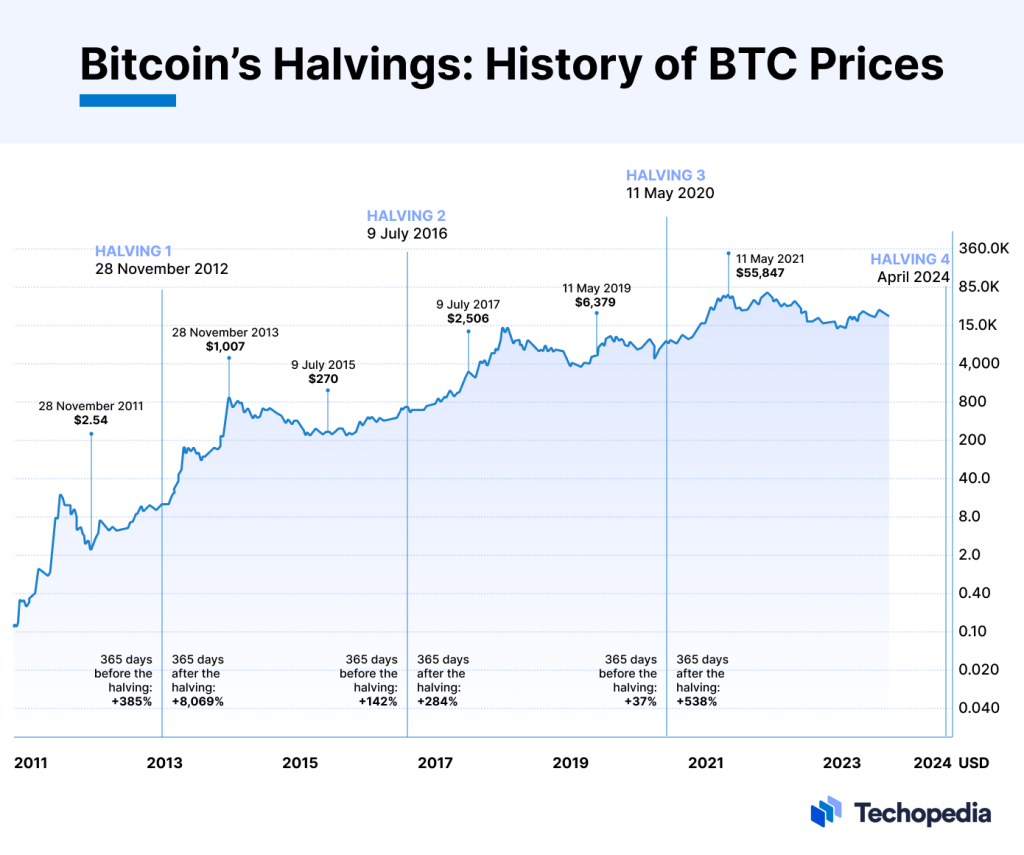

Let’s look at how one key aspect of Bitcoin’s early design is doing today: the halving. Bitcoin has now experienced 3 halvings, reducing the original reward of 50 Bitcoin per block down to 6.25 currently.

These sharp reductions in the new supply of Bitcoin were a critical part of Satoshi’s design. Halvings have helped keep the price of Bitcoin on a volatile but upward trajectory. The chart below shows the 3 halving events so far along the price (in log scale).

Sometime around April of 2024 we’ll experience the next halving, bringing the per-block reward to 3.125. That will take total daily rewards for miners from around 900 to around 450 BTC.

It could be a difficult adjustment period for us miners, but halvings are a key part of Bitcoin’s design. And it’s important to remember that historically, the sudden reduction of new supply entering the market (as miners sell coins) has also been bullish for the price of Bitcoin over the long run.

I’ve read most of Satoshi’s writing, and I believe he’d be pleased with the state of Bitcoin. The mechanisms he designed have stood the test of time. The network is battle-tested. It has many millions of users and processes hundreds of thousands of on-chain transactions daily.

In today’s chaotic world, Bitcoin is more important than ever. As HIVE Executive Chairman Frank Holmes said in his recent speech at Bitcoin Amsterdam, “Bitcoin is about freedom and it’s about private property.” I think Satoshi would agree.

Cheers,

Adam Sharp

Editor, The HIVE Newsletter