By: Adam Sharp

The HIVE Newsletter

On Sunday, March 12, the Federal Reserve, FDIC, and Treasury Department took the rare step of issuing a joint statement. The intro read:

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system.”

A few chills run down my spine reading those words.

Among other measures, the Fed announced a boost to banks with the BTFP, a new lending facility that values securities at par (full value), even though they are trading well below par. There is considerable debate whether this constitutes a bailout, but it does seem to fit the description.

The problem facing certain banks is a side effect of higher interest rates. Some banks (like Silicon Valley Bank) purchased substantial amounts of U.S. Treasuries when rates were still low.

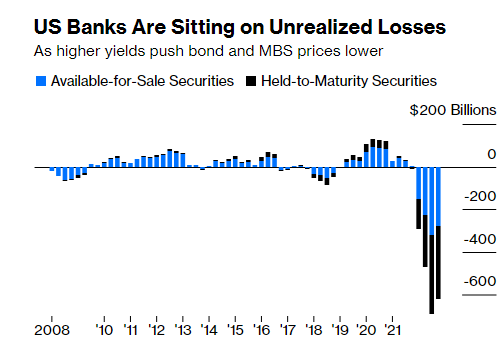

As interest rates shot higher, the value of those low-yield bonds fell sharply. This created large unrealized losses at banks and other institutions, as shown in the chart below from John Auther’s 3/13 opinion piece in Bloomberg titled “Fed Rate Pivot Is Back in Play“.

(Note the spike in unrealized losses around 2018, when the Fed was tightening, and how it reversed once the Fed cut rates beginning in the summer of 2019.)

The Fed’s rapid tightening has started breaking things. The chance of a Fed pivot (shift toward easing) has grown significantly.

Here is what I wrote on the matter in October of 2022:

I believe we’re getting closer to a pivot now, and that it will largely depend on if (when?) systemically important things start breaking.

…For now, the Fed seems resolute in its mission. But what happens when something important breaks?

…If financial markets do start to break, will the Fed press forward, continuing to choke off liquidity? Will they stand by as another global financial crisis unfolds? As the 20% of US companies which are “zombies” (debt servicing costs > profits) go bankrupt?

The Federal Reserve is in an extremely tricky spot here. If they pivot to easing, they may lose control of inflation. But if they don’t, the financial system could be in trouble. It’s the mother of all pickles, and I don’t envy Jerome Powell and his colleagues at the Fed.

Bitcoin Was (Literally) Made for This

Lately I can’t help but think about the words Satoshi Nakamoto inscribed on Bitcoin’s genesis block in January of 2009.

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

Did the message simply reflect a significant news event of the time, or was there a deeper meaning here? Satoshi expanded on his views in a post from February 2009.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

It’s clear what motivated Satoshi to create Bitcoin. He felt the world needed a decentralized, electronic, and secure form of money. Bitcoin was born.

We’ll be following this situation closely and will keep readers updated.

Related reads:

- Last Time the Fed Pivoted, Bitcoin Ripped $60k Higher

- Is The Bottom in For Bitcoin?

- Riding Out The Crypto Bear Market

Stay safe out there,

Adam Sharp

The HIVE Newsletter

P.S. we’ve updated The HIVE Newsletter blog, making it easier to sign up. If you enjoy our content, consider sharing with a friend.