Over the last year, Bitcoin’s mining difficulty has risen about 53%. In the same period, the price is down ~32%.

These two factors have created a challenging environment for miners. Efficiency and execution are critically important during such periods.

Today we’re going to examine three areas which demonstrate just how lean and mean HIVE operates.

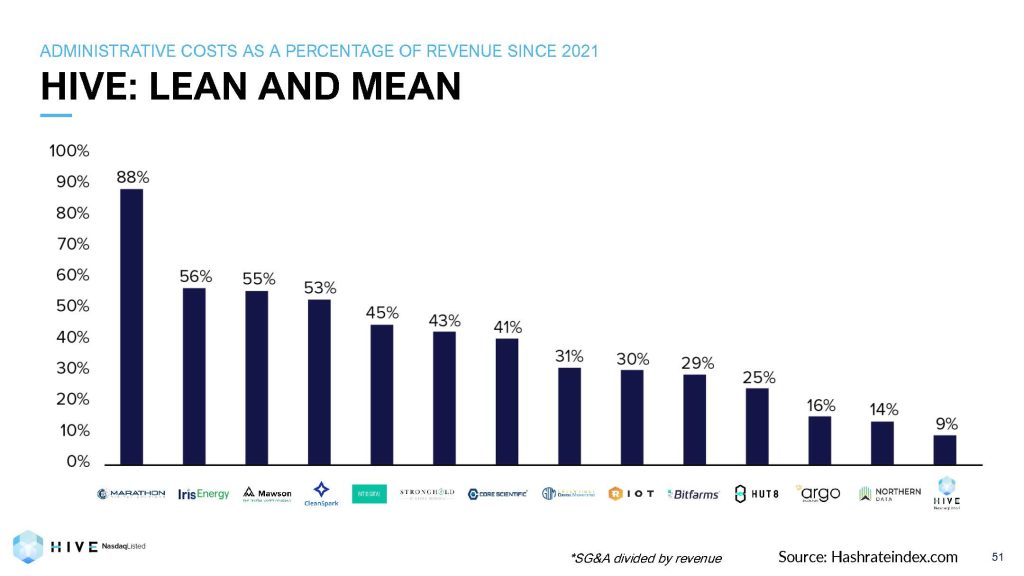

Lowest Admin Costs (G&A) in the Industry

This first example shows administrative costs as a percentage of revenue since 2021. Admin costs include things like executive compensation, legal and consulting fees, insurance, etc.

This chart is adapted from work by Jaran Mellerud over at HashRateIndex.com.

The bar chart tells the story here, with HIVE coming in first at 9%. That’s lean.

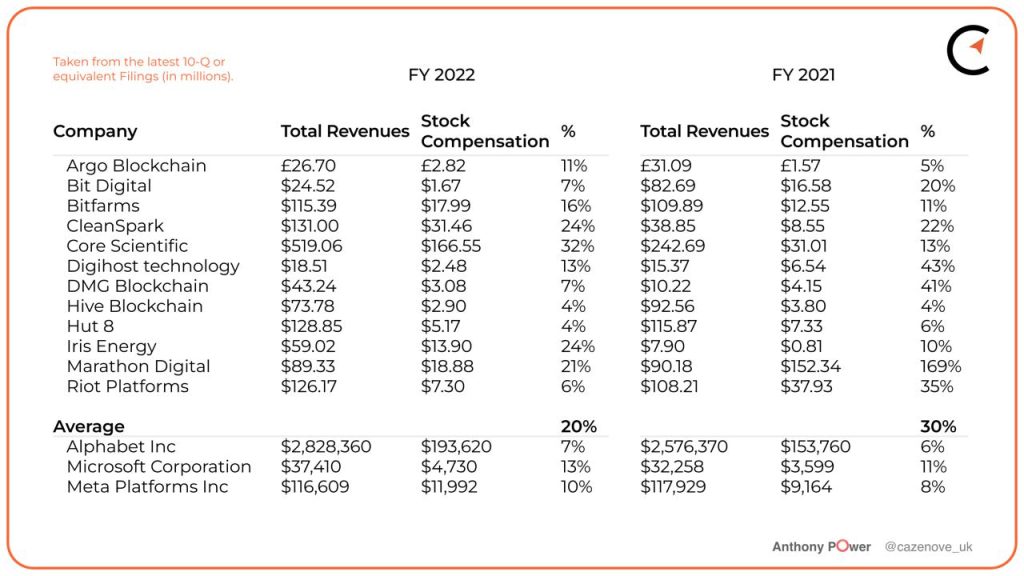

Stock Comp

Next up, let’s look at stock compensation as a percentage of revenue. Once again, HIVE is looking good here with just 4% of revenue as stock comp for 2021 and 2022.

This research is by Anthony Power of Compass Mining, from his article titled The true cost of stock compensation.

HIVE landed in first place in this category, with stock comp making up 4% of revenue in both fiscal 2021 and 2022.

For comparison, Anthony includes Alphabet, Microsoft, and Meta, coming in at 7%, 13%, and 10%, respectively, in 2022.

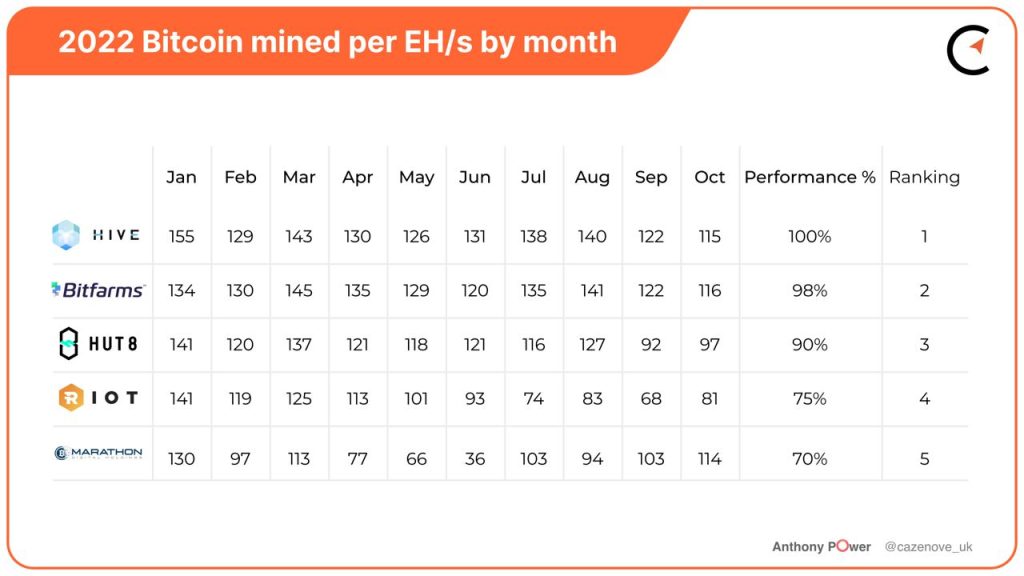

Bitcoin Mining Efficiency

Finally, let’s look at Bitcoin produced by hashrate (measured as Exahash/second). This is from Anthony Power’s article titled Ranking the top five Bitcoin miners, part II.

Bitcoin mined per EH/s is a metric which indicates how efficiently a miner manages its resources and operates its assets. HIVE achieved its top ranking through:

- High uptime

- Fleet upgrades

- Hardware + software optimization

- Infrastructure + logistics execution

Explaining The Gap

Why does HIVE stand apart in these areas? I believe part of the explanation lies in HIVE’s culture.

As we discussed a few weeks ago, HIVE went public in September 2017. It was just a few months before the bear market of 2018 began. This experience instilled discipline and a lean mentality which remains strong today.

Another factor is that HIVE focused its GPU sourced computational power towards securing the Ethereum network from 2017-2022, which was more lucrative than Bitcoin. This was a shrewd move by management which demonstrated the company’s ability to think differently.

Currently, the company is working on utilizing its high-end GPUs to power AI and HPC cloud applications. HIVE CEO and President Aydin Kilic explained in HIVE’s most recent earnings release that these GPU efforts “are currently doing $80 per megawatt hour in revenue, which is similar to Bitcoin mining economics with ASICs”. The annual run rate from HIVE’s GPU operations is around $1.3 million, and leadership sees significant room to scale.

Prior to the Merge, HIVE utilized the cash flow generated from ETH operations into building up its capacity for Bitcoin mining through two smartly-timed data center acquisitions in North America.

So despite the fact that Bitcoin’s difficulty rose more than 50% during the last year, HIVE managed to increase total Bitcoin production in the quarter ending December 31, 2022, by 13% year-over-year.

HIVE will continue to operate with a lean philosophy, while investing in potentially lucrative areas such as AI/HPC.

We go into these issues in far more depth in our most recent earnings webcast. Check it out below.

Cheers,

Adam Sharp

Author, The HIVE Newsletter