By: Adam Sharp

HIVE Blockchain

Nasdaq: HIVE | TSX.V: HIVE

In September of 2017, HIVE Blockchain Technologies went public on the Toronto Venture Exchange. The company was the first cryptocurrency miner to do so in North America, and it was no small feat navigating the regulatory aspects of such trailblazing.

For a brief three months, things seemed peachy. Then the crypto bear market began.

The price of Bitcoin would fall from a 2017 high of near $20,000, to down around $3,200 in late 2018. Ethereum fell from over $1,300 in early 2018 to less than $100 by December of ‘18. Most “altcoins” fell even more.

To survive as a miner in such an environment, you have to adapt. HIVE ran lean, with a small dedicated full-time team. The company made use of reliable, flexible contractors where possible. The team slashed costs and fixed inefficiencies.

HIVE continued to build and expand our mining footprint throughout the bear market. By the time crypto markets started to recover in 2019, we had one of the world’s largest Ethereum mining operations.

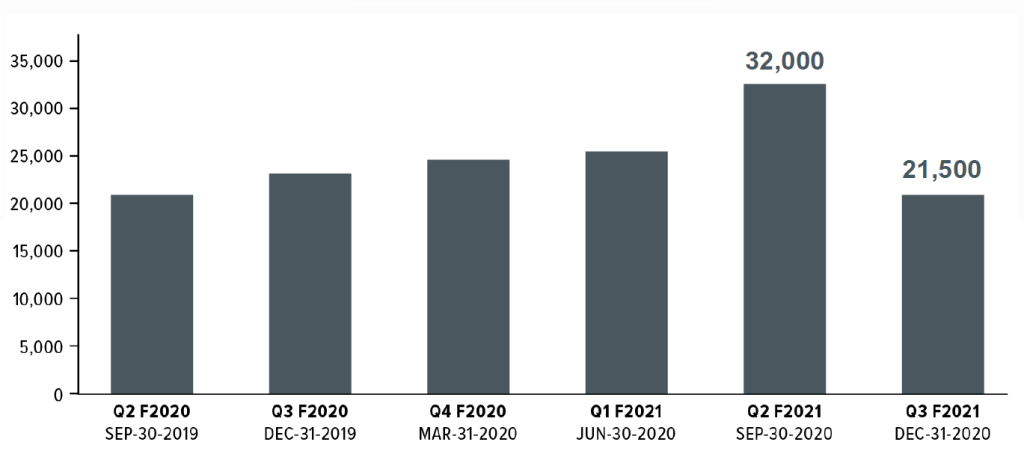

Ethereum mined by HIVE Blockchain, Sept 30 2019 – Dec 31 2020

HIVE continued mining Ethereum until the merge finally occurred in late 2022. But we didn’t just sit on the cash flows generated by these operations.

Starting in 2020, we invested heavily in Bitcoin mining, purchasing two major mining campuses located in Canada.

The picture below is of HIVE’s New Brunswick data campus. Since this picture was taken, we’ve added two new buildings, and many thousands of high-end Bitcoin mining machines.

And unlike many of our competitors, HIVE owns its machines outright. We do not have burdensome debt financing on our equipment.

In December of 2022, HIVE produced 213.8 Bitcoins. We are actively expanding our BTC mining operations, including an exciting deal with Intel in which the company just received and installed 1,423 HIVE Buzzminers using Intel’s new Bitcoin mining ASIC.

In addition, in our December production update, HIVE leadership expanded on bear market opportunities:

Last quarter HIVE strategically sold Bitcoin to increase cash reserves to fund opportunistic expansions in the technology bear market. Mr. Holmes stated “We have seen a great opportunity to expand in this depressed market, where ASIC prices are down almost 90%, whereas Bitcoin price is down approximately 70%. Acquiring ASICs at steeply discounted prices positions us for ideal return on invested capital, and further decreases our cost of production for Bitcoin, and improves our gross mining margin in the interim bear market.”

We believe Bitcoin has a role to play in the future of money. The world needs scarce, apolitical, censorship-resistant money. Today we provide approximately 1.5% of the world’s Bitcoin hashrate. And we’re looking to continue and expand that stewardship long-term.

Keep Building

If you hang around the crypto world long enough, one recurring theme you may notice is that those who build in bear markets get rewarded when the bull comes back around. That is what HIVE is focused on today.

The company is also exploring areas such as cloud AI and HPC (high performance computing) as ways to utilize our fleet of powerful GPUs (which were previously mining Ethereum). Recent breakthroughs in AI models, such as Stable Diffusion and ChatGPT may be about to create massive demand for GPU compute. Read more about that in HIVE’s recent newsletter.